Experience the superior standard in interest rate, speed and customer service.

|

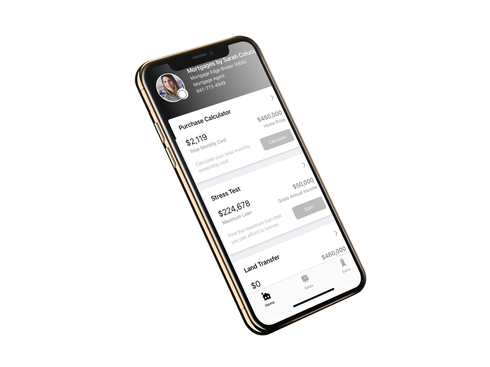

Welcome to Mortgages by Sarah Colucci.

With over twenty years of experience in mortgage financing and Canadian real estate, you can be confident in my ability to offer you the best mortgage rates in the fastest time, and never wavering on customer service. Whether you are just starting your real estate journey as a first-time buyer or are a seasoned investor, I am your partner in unlocking the financing possibilities. |